For All Your Money Goals

We're here to help you save more, borrow smarter, and build a stronger future.

Our Members Come First

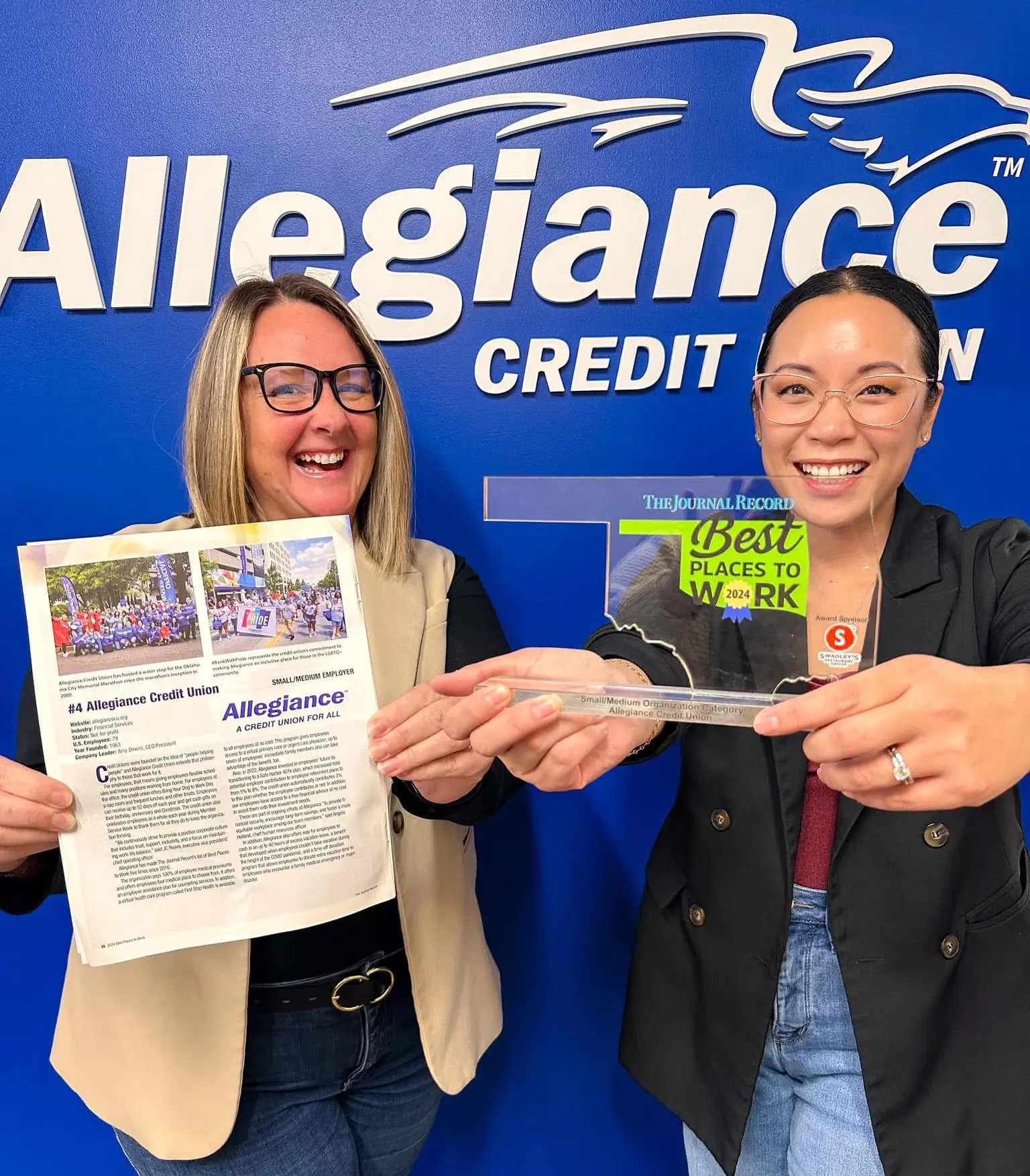

Join The Best Credit Union in Oklahoma City!

Join a community that puts you first. At Allegiance Credit Union, we offer personalized service, better rates, and a commitment to your financial success. It's as easy as 1, 2, 3!

Apply Online

Complete our online application to become the newest Allegiance Credit Union member.Fund Your Account

Enjoy the Benefits

We'd Love To Hear From You

Call Us

Video Banking

Our secure video chat makes it easy to get the support you need. Use your computer or Mobile Banking App to start a call with us today.Web Chat

When you see the chat bubble at the bottom of your screen, our friendly team is ready to chat. Get fast answers to your questions and personalized guidance when you need it!Click the bubble to start a chat with us!

Contact Form

Complete our contact form to email our team. Because of the insecure nature of email, please do not include personal information such as account number, social security number, or PIN number in this message.Mobile Banking Tools

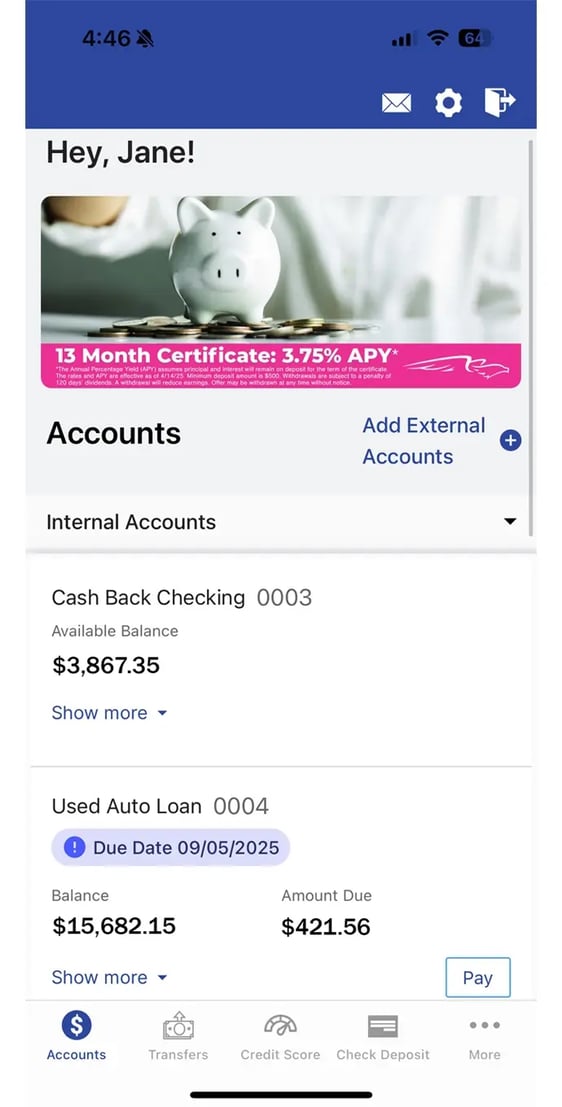

Whether you're at home in Oklahoma or traveling across the globe, the Allegiance Mobile Banking App puts powerful tools at your fingertips. Get real-time alerts, monitor your credit, turn off your debit card, and more with convenient access to your accounts anywhere, anytime.

-

-

Monitor Your Credit Report

Stay on top of your finances with free credit score monitoring. Access your credit report daily to spot changes early and see what impacts your score. It’s smart credit management for all who want to take control of their financial future.

-

-

/Member%20Referral_Krysi%20and%20Brandi.webp?width=1800&height=1800&name=Member%20Referral_Krysi%20and%20Brandi.webp)

For All Your Friends And Family

Get Paid to Refer Your Friends

Allegiance Credit Union members can earn money just for referring friends and family!

- Get $50 if you refer a new checking account!

- Get $100 if you refer a loan over $10,000!

There are NO LIMITS to how many friends you can refer. Just tell your friends and family to mention your name at account opening or during the loan application process either in-branch or online.

Member Referral Program Details:

Members can earn $50 if their referral generates a new checking account. New account holder must mention the name of the person who referred them at account opening in-branch or on their online application. Cash bonus will be deposited to referring member's account within 30 days of account opening. Offer may be withdrawn at any time without notice.

Members can earn $100 if their referral generates a new loan of $10,000 or more. Loan applicant must mention the name of the person who referred them during the application process. Cash bonus will be deposited to referring member's account at the time the loan is funded. Offer may be withdrawn at any time without notice.

What Our Members Are Saying

"ACU is not just a financial institution, it is truly a community. I have been a member since I was a kid and my family before me, and it is a resilient, strong community."

Megan B.

"I feel like all of my interactions with ACU have been focused on my financial health and well-being as opposed to what might most benefit the credit union."

Kevin M.