HELOC vs Home Equity Loan: Which is Best?

When community members need access to cash, home equity can be a valuable asset for low-interest borrowing opportunities. A Home Equity Line of Credit, often referred to as a HELOC, and a Home Equity Loan are typical solutions that utilize the home’s equity as collateral and offer competitive low-interest rates. After speaking with a lending professional, the decision often comes down to a HELOC vs Home Equity Loan. Both options are backed by the equity in someone’s home that allows them to borrow as much as 80-90 percent of the appraised value, in some instances.

With a reasonably good credit score and repayment history, homeowners can position themselves to acquire one of the lowest interest loan products available. But making an informed HELOC vs Home Equity Loan decision tasks working families with understanding the subtle differences between them. If you need additional funds for home improvements, debt consolidation, unanticipated expenses, or discretionary spending, consider the following HELOC vs Home Equity Loan distinctions.

What is a HELOC

A Home Equity Line of Credit (HELOC) allows qualified borrowers to secure discretionary funds using collateral. Qualified homeowners can use the difference between fair market value and the total principal balance of the mortgage and other debts — commonly referred to as “equity” — as collateral. In this way, a HELOC loan is secured, and that gives local credit unions the ability to provide a low-interest borrowing option.

Although borrowers do not swipe a card tied to their HELOC at local restaurants and big-box retailers, per se, the loan product functions like a credit card in many ways. What initially makes a HELOC resemble a credit card is that borrowers withdraw money against the preset limit. They can then make ongoing repayments and withdraw more money over a set period of time. Like credit cards, the minimum balance and monthly payment can fluctuate. Borrowers can use the line of credit for items that include the following.

- Home Improvements: Upgrading kitchens, bathrooms, and new roofs rank among the common uses for HELOC loans. The strategy revolves around re-investing into the home and improving its value.

- Emergencies: Emergency repairs or expenses are conveniently covered with a HELOC. Even the high cost of medical expenses can upend someone’s otherwise stable financial portfolio. A HELOC loan can be leveraged when emergency spending is required.

- Big Ticket Items: From in-ground swimming pools to paying for a wedding, HELOCs offer a cost-effective and flexible spending options. Using this line of credit allows borrowers to enhance their quality of life tailoring it to their specific needs.

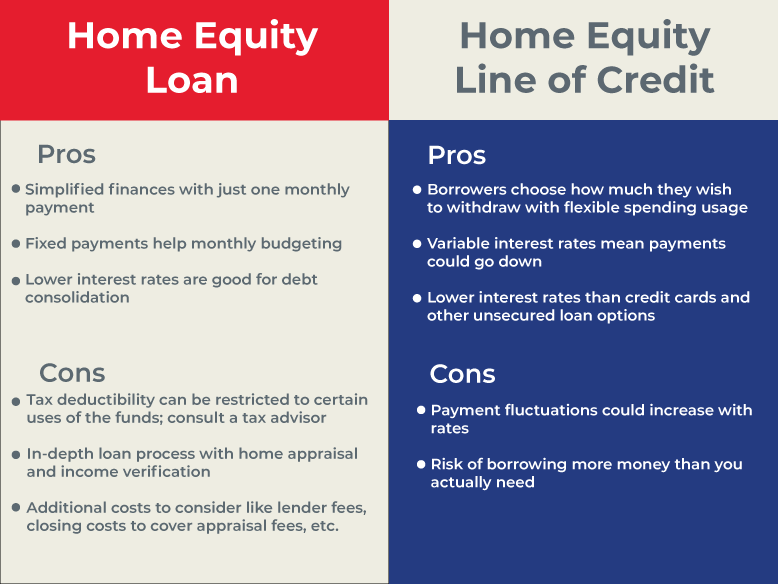

Although these loan products are thought of as “revolving credit,” they typically involve specified withdrawal and repayment periods. It’s not uncommon for borrowers to enjoy a withdrawal period of up to 10 years, followed by a repayment period of 10 years. To understand the HELOC succinctly, the following are generally considered its pros and cons.

- Pro: Borrowers choose how much they wish to withdraw.

- Pro: Variable interest rates mean payments could go down.

- Pro: Lower interest rates than credit cards and other unsecured loan options.

- Pro: Flexible spending usage that includes emergencies.

- Con: Payment fluctuations could increase with rates.

- Con: Failure to repay the loan could put the home in jeopardy.

- Con: Impulse spending may be a concern.

That being said, Home Equity Loans are similar in many ways. But knowing the pros, cons, and differences provides borrowers with the facts to make informed decisions.

What is a Home Equity Loan?

Like a HELOC, a Home Equity Loan also leverages the home as collateral to back the product. This option is usually referred to as a “second mortgage” because qualified homeowners receive a lump-sum amount and repay it in monthly installments similar to a first mortgage. This, in turn, reduces the lender’s risk and creates opportunities for low-interest borrowing options. Home Equity Loans can be used for purposes that include the following:

- Debt Consolidation

- Home Improvements

- Family Vacations

- Wedding Expenses

- Emergency Spending

- Business Needs

In fixed-rate Home Equity Loans, borrowers start making monthly payments immediately, and that figure remains the same for the life of the loan. Working families often like the fact they know precisely how much of their monthly budget will go toward repayment.

Like other borrowing options, a portion of each payment goes toward interest, with the remainder tamping down the principal. Lenders offer repayment options that range from five to 30 years in some cases. Local credit unions typically provide flexible terms that make sense for residents’ budgets and goals. People who leverage real estate to acquire a Home Equity Loan usually site the following as pros and cons.

- Pro: Lump sum payments reduce impulse spending urges.

- Pro: Fixed payments help monthly budgeting.

- Pro: Lower interest rates are good for debt consolidation.

- Con: Failure to repay jeopardizes your home.

- Con: Cannot benefit when interest rates go down.

Home improvements and consolidating high-interest debt rank among the more prevalent uses for Home Equity Loans. That’s largely because these secured loans save working families money compared to credit cards and personal loans.

When is a HELOC better than a Home Equity Loan?

People often ask themselves what the HELOC vs Home Equity Loan core differences are and which is better? But the truth of the matter is that loan products provide different types of benefits for qualified borrowers. The goal for applicants is matching their ability to borrow with a loan that best meets their immediate and long-term goals. Although both loan types represent excellent low-interest borrowing opportunities, an increased number of people prefer a HELOC loan for the following core reasons.

- Borrow Only What Your Need: In terms of a HELOC vs Home Equity Loan comparison, the former tends to be the preferred choice because borrowers can withdraw only what they need. This comes into play for items such as home improvements when cost estimates are unclear. Taking out a lump sum often leaves people paying back the money they didn’t need, with interest.

Although the HELOC tends to be the preferred choice among homeowners, Home Equity Loans can also make sense under the right circumstances. For example, if you know exactly how much you need for an expense such as a home improvement or debt consolidation, a Home Equity Loan could be the right choice for you. This holds particularly true for people who live on fixed incomes or those on a tight budget who require static money management numbers.

How to Decide Which Is Right For You

The HELOC vs Home Equity Loan decision often proves challenging for everyday people. But putting your property’s equity to work can be a financial game-changer. The ability to consolidate debt or make necessary household upgrades improve the quality of life for any family.

The decision generally comes down to the withdrawal option and getting the best possible interest rates and repayment terms. If you are unsure how much you need to spend or like to pay as you go, the HELOC usually makes the most sense. When comparing available solutions, be sure to start with your local credit union that offers among the lowest interest rates and flexible repayment terms on the market today. As not-for-profit institutions, credit unions are designed to serve the financial needs of the community and their members, not generate profits for their shareholders. When it comes time to apply for your HELOC or apply for your Home Equity Loan, you can feel confident that you have performed enough research to enjoy your decision and your future plans for the money.